Safeguarding customer data isn’t just a best practice; companies that fail to comply can pay hefty fines and lose consumer trust. For example, credit bureau Equifax had to pay at least $575 million in fines to the Federal Trade Commission for a data breach affecting 150 million people in 2017. Large social media companies, banks and tech giants who run afoul of regulations may be able to weather the storm, but it’s unlikely smaller businesses could pay those fines or suffer the public relations damage and stay afloat.

Fortunately, companies of any size can avoid these sorts of mistakes by by prioritizing compliance to mitigate risks and ensure operational integrity. A well-defined compliance strategy helps in adhering to laws and regulations while fostering trust among stakeholders, customers and employees.

Explore compliance strategy, including seven steps to create an effective compliance strategy that aligns with your organization’s goals and values.

What is a compliance strategy?

A compliance strategy is a blueprint for your organization for staying on top of regulations and compliance. This includes policies for employees, IT teams and leaders to mitigate risk, follow government regulations and uphold industry standards to prevent data breaches or other security incidents. The strategy also includes plans on what to do if a breach occurs to minimize the damage and correct issues.

Why should you develop a compliance strategy?

Today’s regulatory environment is complex and constantly evolving, and compliance won’t just happen at your organization. Developing a compliance strategy gives your company a systematic approach to regulations and compliance to proactively prevent issues. A good compliance strategy includes clear tasks that every employee can follow to enhance risk management across the organization. Additionally, it should align with the company’s mission and be scalable over time to promote growth.

Highly regulated industries such as finance, healthcare, food, insurance and real estate require constant vigilance to ensure compliance as regulations change over time. Small businesses must also comply with data protection regulations and laws, and a compliance strategy ensures adherence regardless of company size. Compliance can also apply to product or service quality, including consumer safety laws.

Companies that fail to comply with regulations face hefty fines from regulators and lawsuits. At the same time, consumers, investors and stakeholders quickly lose confidence in companies that have data breaches or other security incidents due to failure to maintain compliance requirements. A compliance strategy is the best way to build your business on a foundation of trust and keep compliance risk to a minimum.

How to create and implement a compliance strategy

Your organization’s compliance strategy will depend on your business, including industry, business operations, workforce and technical scope. However, there are seven basic steps any company should follow to develop and implement a compliance strategy:

1. Define compliance goals

Start by considering the overall goals of your compliance strategy. Your organization may need a compliance program for any number of reasons, including:

- Adhering to government laws and regulations

- Improving quality standards for goods or services

- Developing trust while handling large amounts of sensitive information

- Maintaining intellectual property or proprietary information

- Empowering employees to understand compliance issues

Communicating these goals effectively across the organization establishes the reasoning for your compliance efforts, which helps you get buy-in from employees, managers and leadership.

2. Evaluate regulatory requirements

Different industries and businesses are required to follow different regulations. Start by researching any local, state and federal laws pertaining to your business, including tax regulations, data protection policies and safety requirements. There may also be governing organizations for your company’s industry that determine regulations and compliance enforcement for specific standards.

Make a list of current regulations and keep track of how often they’re updated by the governing body in charge of them. Many government agencies or industry groups will send automated notifications when a regulation has been updated. Depending on the size of your business and the number of regulations you’re required to follow, you may want to assign compliance officers to ensure your policies and procedures are up to date over time.

3. Conduct a risk assessment

A comprehensive risk assessment allows you to identify potential risks and their possible impact on the company so you can further understand why it’s important to adhere to regulations and policies. Start by analyzing internal processes, systems and controls including data handling, financial reports and employee training programs.

Once you’ve identified possible risks, determine what impact they could have and how likely they are to happen. This helps you prioritize risks and determine which areas require immediate attention. A risk matrix is a useful tool for visualizing and categorizing risks based on their severity and probably. Consider factors like financial loss, reputational damage and legal implications. Involve key stakeholders across the organization in the process to get a more nuanced understanding of how different risks may affect various aspects of the organization.

4. Develop compliance policies and procedures

The next step is to develop your compliance strategies and procedures based on your research and findings. These documents are the backbone of the compliance strategy and ensure that all employees understand their roles and responsibilities in maintaining compliance within the organization.

The policies should outline the following:

- The organization’s commitment to compliance

- Reasoning behind compliance policies

- Specific rules and expectations for employees

- Compliance tasks for individual employees or teams

- Steps for reporting violations and lists of corrective actions

- Employee training plans

- Auditing schedules or plans

5. Implement training and communication

Training and effective communication are vital to a successful compliance strategy. Employees must understand the policies and procedures to ensure compliance at all levels of the organization. Programs should educate employees about compliance policies, relevant regulations and their roles in maintaining compliance. In-person workshops, e-learning modules and refresher courses are standard ways to train employees on compliance processes and instill a culture of compliance.

6. Monitor and audit compliance

Implement regular monitoring and auditing to ensure compliance policies and procedures are followed. These regular assessment identify areas for improvement and ensure your compliance function is up-to-date.

Implement monitoring mechanisms to track compliance activities, including:

- Internal audits with the organization’s compliance officers

- External audits with governing bodies or consultants

- Performance metrics and analytics

- Compliance checklists

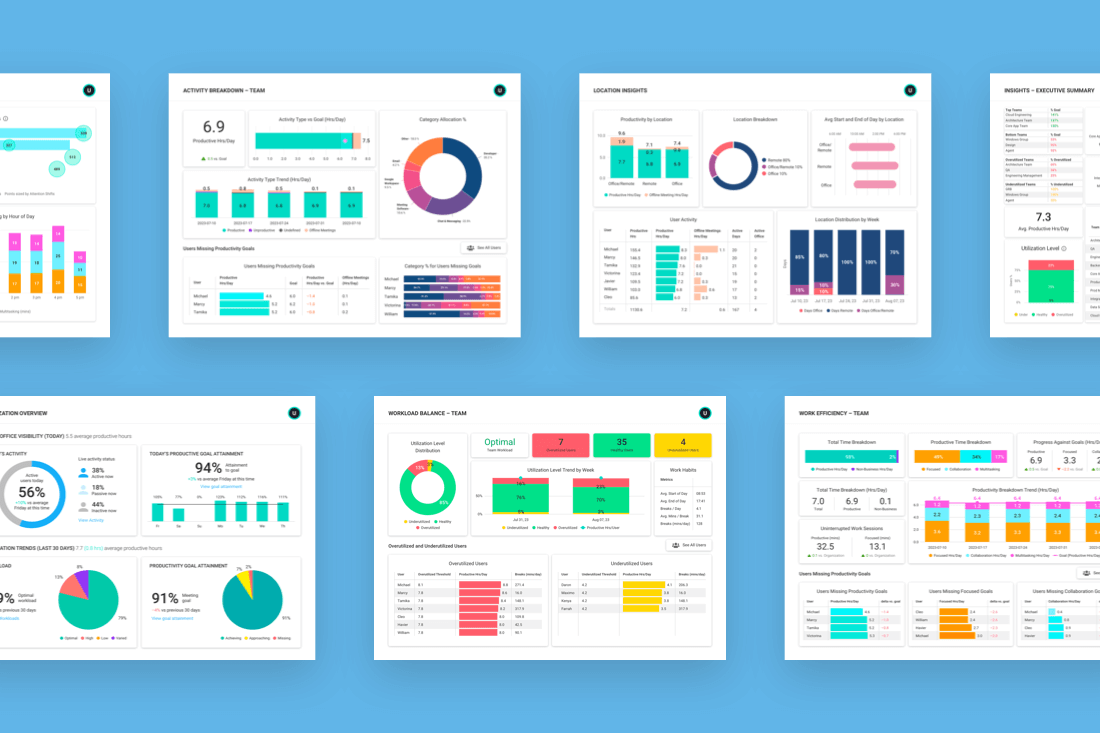

Technology like ActivTrak can streamline the monitoring process by collecting and analyzing data as well as providing automatic compliance controls like real-time employee notifications and reminders.

7. Review and improve the compliance strategy

Finally, establish a process for regular review and continuous improvement for your compliance strategy. Regulatory compliance is an ongoing commitment that requires regular evaluation. Use feedback from employees and stakeholders to gauge how effective your compliance strategy is and gain buy-in. Be prepared to adapt your compliance strategy as regulations evolve so it stays relevant and effective.

Monitor and improve compliance with ActivTrak

A strong compliance strategy gives your organization a roadmap for navigating regulatory requirements and social expectations from consumers and stakeholders. Leveraging technology like ActivTrak in your compliance strategy gives you a leg up against the competition in ensuring compliance.

ActivTrak’s employee monitoring solution empowers you to collect and analyze historical compliance data to identify gaps and hone your strategy. The solution also gives you powerful tools for enforcing compliance in real-time with customizable alerts on possible risky behavior or security breaches.

Take your compliance strategy to the next level with ActivTrak. Contact our sales team today to get started.