The world of insurance moves fast, and insurance companies are learning to prioritize operational efficiency to keep up. As the industry evolves with technology and consumer expectations shift, insurance companies must be more strategic and intentional about operations management. Streamlining operations management enhances productivity while improving customer satisfaction and reducing costs. Explore effective strategies to streamline insurance operations management, focusing on process optimization, technology integration and workforce management.

Challenges in insurance operations management

Insurance companies face challenges in operations today, many of which are unique to the industry. Whether it’s life insurance, health insurance, auto insurance or others, all insurance is subject to complex regulations and compliance standards. Insurance companies must ensure employee policies and updated technology fit with risk management best practices. Changing attitudes from both employees and customers also affect the insurance industry in unique ways.

Talent acquisition and retention

More and more employees say they want a hybrid or flexible work arrangement, and insurance companies that want to stay competitive have had to adapt. Remote or hybrid teams need up-to-date tools and technology to effectively serve customers and collaborate while maintaining regulatory compliance.

Legacy system constraints

Many insurance companies rely on old technology or systems for their business operations, due in large part to regulatory constraints. At the same time, startups and other technology disruptors are creating pressure on longstanding organizations to change how insurance companies operate. Leaders at insurance companies must make difficult choices on new tools to effectively manage data and integrate with operational technology while finding ways to reduce operating costs.

Siloed organizational structures

Keeping teams and individuals collaborating across departmental boundaries is difficult for most modern companies, including insurance businesses. Whether departments aren’t communicating with each other or remote and hybrid teams are facing accessibility challenges, insurance companies need to understand where siloes exist and how to fix them.

Meaningful performance measurement

Insurance companies need a full understanding of how teams and individuals are performing to keep up with customer expectations and ensure work is done to quality standards. Measuring performance also creates opportunities to improve workflows and provide effective training.

Data privacy and security

Claims processing, underwriting decisions and account management all require large amounts of personal data, including health information, financial information and other identifying information. Insurance businesses must ensure customer data is secure while working to scale technology.

Customer service and support

Customer expectations have changed recently, and health insurance companies in particular have come under scrutiny for their claims management and customer service processes. Today’s insurance customers expect a seamless digital experience, personalized service and quick responses. As costs go up for many insured individuals, these demands mean industry companies must find ways to improve customer service while still keeping an eye on compliance and their own costs.

How poor insurance operations management drains productivity and performance

Poor operations management leads to poor outcomes for insurance companies. Without effective operations management, insurance companies will quickly see unhappy employees, unhappy customers and unhappy state insurance commissioners. Without streamlined operations management, insurance companies risk:

- Reduced profitability and higher costs due to waste from outdated technology, manual processes or redundancy.

- Worse customer service scores from policy issuance errors, slow claims processing and confusing underwriting processes combined with slow or inaccessible customer support channels.

- Lower competitiveness due to slower time-to-market for insurance products and poor reputation from customer reviews.

- Legal issues, fines and sanctions from compliance failures and data security breaches (which also erode public trust in the company).

- Reduced employee satisfaction and morale, fueling lower productivity and higher rates of burnout, all of which lead to a reduced bottom line.

Strategies for streamlining insurance operations

To streamline operations management in your insurance organization, there are several strategies:

1. Process mapping and optimization

Understanding existing processes is the first step toward optimization. Process mapping allows insurers to visualize workflows, identify bottlenecks and assess redundancies. By analyzing these processes, organizations can pinpoint areas for improvement and implement more efficient workflows.

For example, a claims process may involve multiple departments and require various approvals. By mapping out this process, insurers identify potentially unnecessary steps and streamline approvals, reducing the time it takes to resolve claims.

2. Leveraging technology like AI

Technology plays an increasingly important role in streamlining insurance operations. From customer relationship management (CRM) systems to advanced analytics and artificial intelligence (AI), the right tools enhance efficiency and accuracy. Automating routine tasks like data entry and document management significantly reduces employee workload.

Using data analytics also provides valuable insights into customer behavior and operational performance. Insurance can use this data to make informed decisions, tailor products to customer needs and improve service delivery.

3. Establishing a culture of continuous improvement

Insurance companies who want long-term success must establish a culture of continuous improvement across their organizations. Encourage employees to provide feedback on processes and suggest improvements to foster an innovative environment. Provide regular training and development programs to equip staff with the skills they need to adapt to new technologies and processes.

This mindset of ongoing enhancement must resonate throughout the business, including an organization-wide commitment to following best practices and finding innovative ways to solve problems. Insurers must ensure their operations stay agile and responsive to changing market conditions.

Implementing change in insurance operations management

Leaders and managers must be prepared to make significant changes to existing processes and systems to streamline insurance operations management. It’s important to follow effective change management so implementation goes smoothly and employees embrace the updates.

Build a change management framework

Leverage a structured change management framework to guide your organization through the transition. This should include:

- Clear communication strategies

- Training programs

- Support systems

All employees should understand the reasons behind the changes and their benefits to gain buy-in. Additionally, employees should be involved in the change process to foster a sense of ownership and accountability. This makes it more likely for the changes to be successful.

Measure success

Establish key performance indicators (KPIs) that align with strategic goals to measure operational effectiveness. Checking in on these KPIs regularly allows you to assess the impact initiatives have on operations and make any adjustments as necessary.

Metrics to watch include:

- Claims processing time

- Customer satisfaction scores

- Operational costs

- Employee productivity

Monitoring these indicators helps you stay on track to achieve operational goals over time.

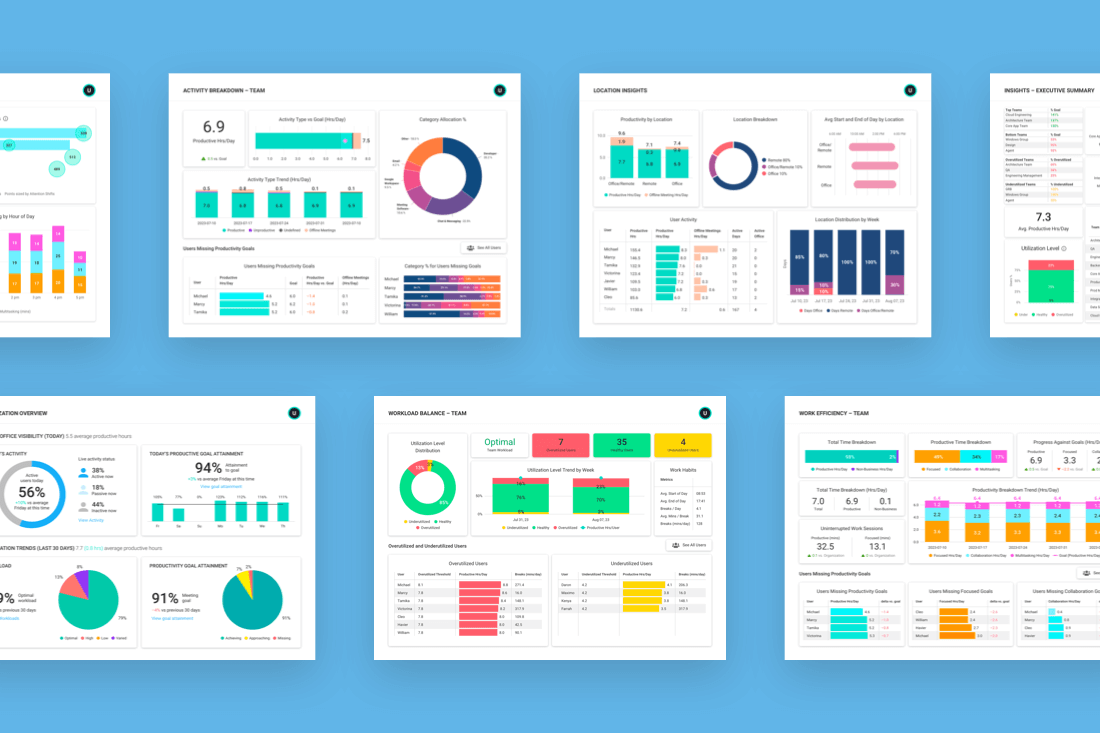

How workforce optimization software helps insurance companies improve operations management

As compliance, technology and employee or customer needs become more complex, insurance business leaders have to juggle competing priorities to optimize their operations. Leveraging workforce optimization software like ActivTrak is an excellent way to simplify the process through meaningful data analytics and insights, automation and easy-to-use reports and dashboards.

For example, workforce optimization software takes the guesswork out of:

- Knowing employees are aligned with strategic business goals by understanding when, where and how employees do their most work, including focus time vs. collaborative time vs. distracted time.

- Seeing which technology and tools are used to get work done compared to technology that is misused or unnecessary, which helps managers understand whether they can let a tool go or increase training.

- Balancing workloads across teams by seeing which agents are over- or under-utilized, preventing burnout and improving customer service.

- Tracking productivity including how much time employees spend on meaningful work vs. repetitive tasks to streamline workflows while identifying top performers and workers who may need help.

Insurance companies that implement workforce optimization software empower employees to create work schedules and routines that enhance their productivity on an individual basis. These solutions also increase accountability while fostering a culture of trust and transparency. Managers leverage the tools to run more effective, productive teams through lazer-focused coaching and more informed feedback. The organization gets a better understanding of workflows, including bottlenecks, as well as productivity trends.

Future trends in insurance operations management

Several trends are likely to shape the face of insurance operations management, including:

1. Workforce evolution

The changing workforce extends beyond offering remote and hybrid work environments. Competitive insurance companies combine insurance experts with technology specialists into cross-functional teams to improve process design and implementation.

2. Regulatory technology (RegTech)

Smart insurance company leaders are starting to adopt real-time systems to track regulatory change and automate updates throughout company processes and systems. These new programs automate compliance tasks like verification, reporting and data management to reduce risk and improve quality.

3. More data-driven operations

As with other industries, insurance companies are leveraging data to better manage their workforces. This includes smarter data analytics that provide insights into trends, current operations and predictive analytics to stay ahead of changing market conditions.

4. Distributed operations platforms

The insurance company of the future will have no problem maintaining a remote, in-office or hybrid workforce across a large geographical area thanks to distributed operations platforms.

Power smarter insurance operations management with ActivTrak

Insurance companies today are finding innovative ways to streamline operations management to respond to complex compliance challenges, changing customer demands and evolving employee expectations. To successfully streamline operations management, leaders must implement a strategic approach that includes efficient processes, new technologies and a commitment to continuous improvement. Beyond reducing costs or increasing efficiency, insurance companies are looking to become more agile in a changing world.

ActivTrak supports insurance organizations in streamlining their operations management with insights and analytics that matter. Optimize productivity, enhance employee well-being and improve workflows with our award-winning workforce analytics solution. Contact our sales team today to start your journey toward reducing waste, optimizing your workforce investments and driving growth in your insurance business.