Trusted by 9,500+ global brands and organizations

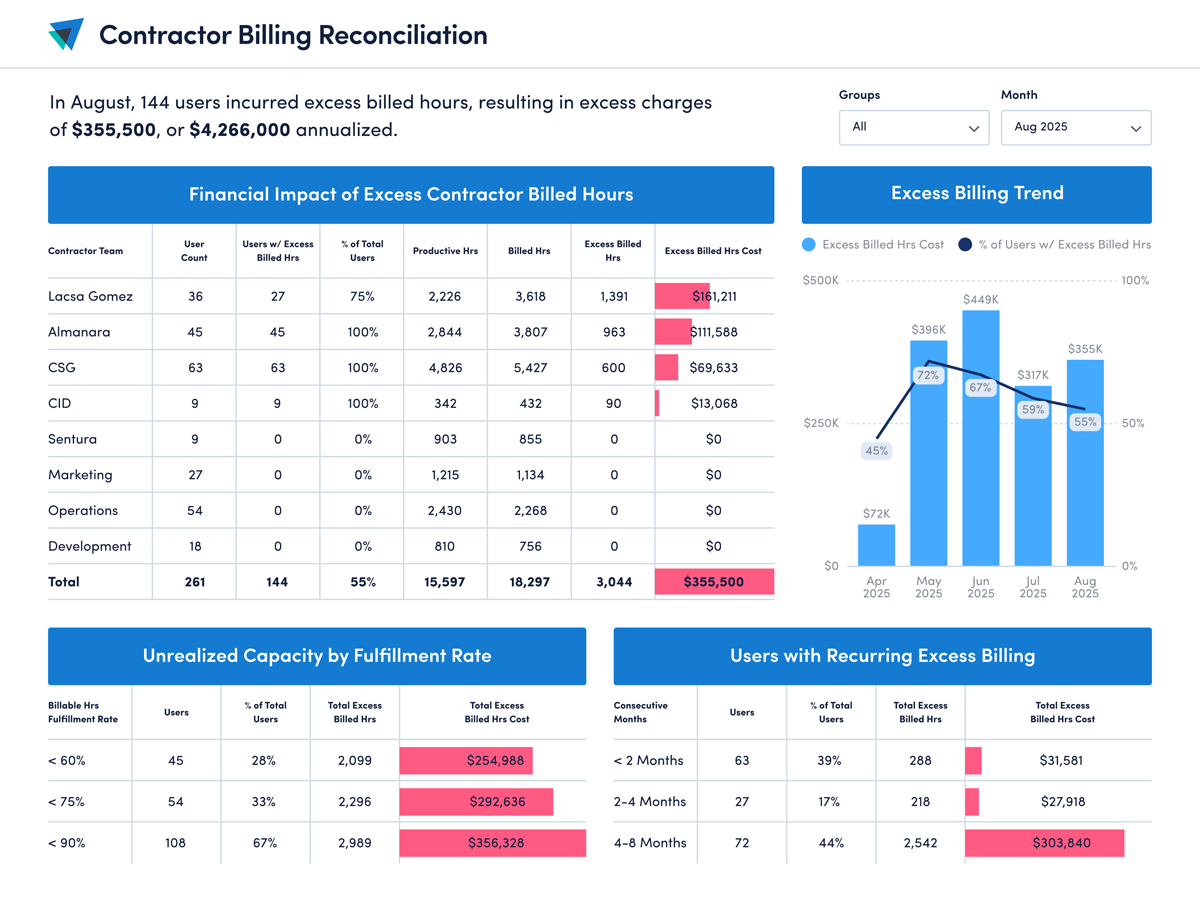

Contractor Billing Reconciliation

Data-driven contractor and vendor management that prevents overbilling

Streamline the vendor reconciliation process with real-time productivity data to reduce manual processes and ensure accurate payments.

- Track productivity against billed hours

- Identify up to 30% in unnecessary spend

- Optimize contractor allocation and spending

- Replace manual audits with systematic monitoring

“With ActivTrak, we have found opportunities to improve the level of engagement with remote staff without losing touch. This allows our management team to continue to focus on managing all staff with consistency and monitor application utilization levels.”

– C-Level Executive in IT

Billing Validation

Track productivity against billed hours

- Compare billed hours to productive hours worked with no workflow changes needed

- Identify billing discrepancies and overcharges automatically while reducing human error

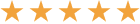

- Analyze trends to spot error patterns and address billing issues proactively

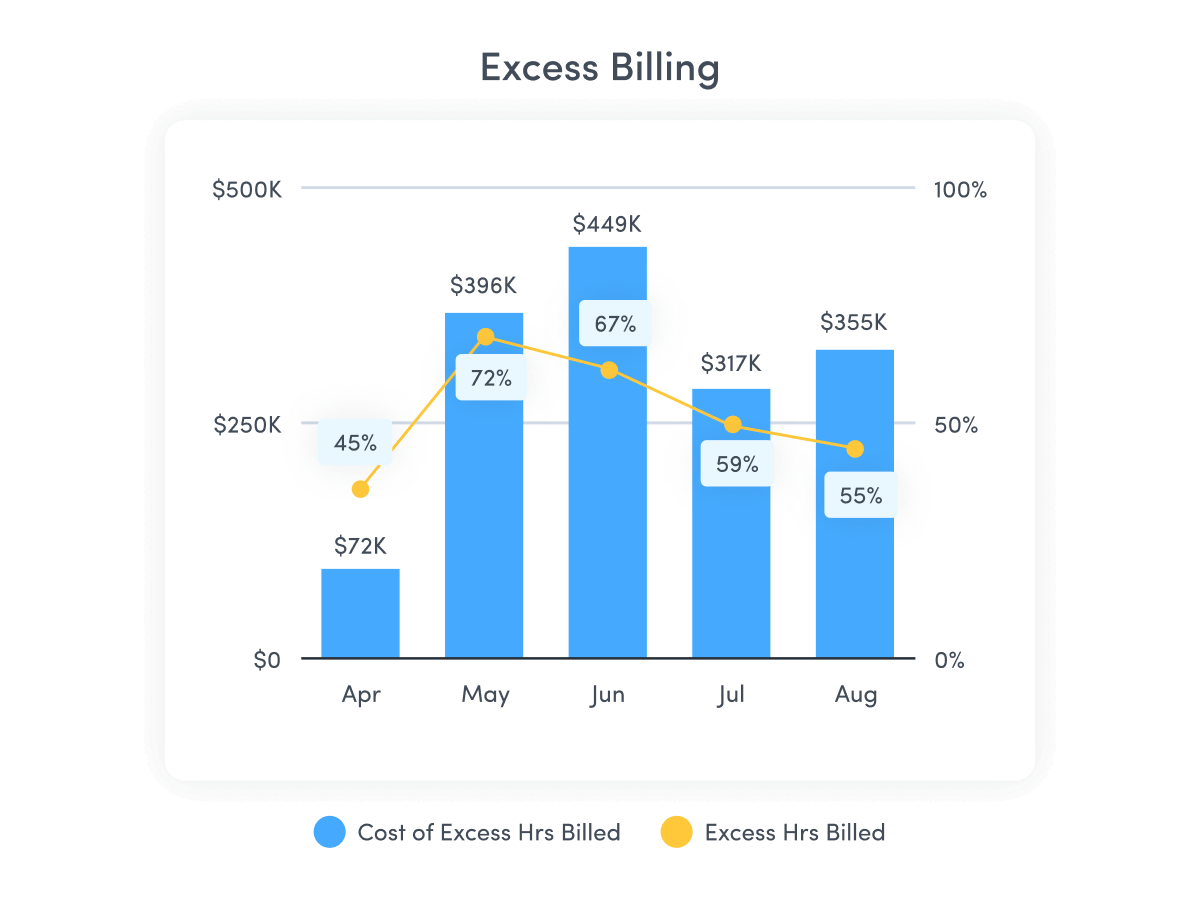

Cost Recovery

Identify up to 30% in unnecessary spend due to contractor overbilling and data entry errors

- Break down excess billing by department and team to improve accountability

- Recover overbilled costs with actionable data

- Maintain accurate financial records for vendor negotiations, dispute documentation and audits

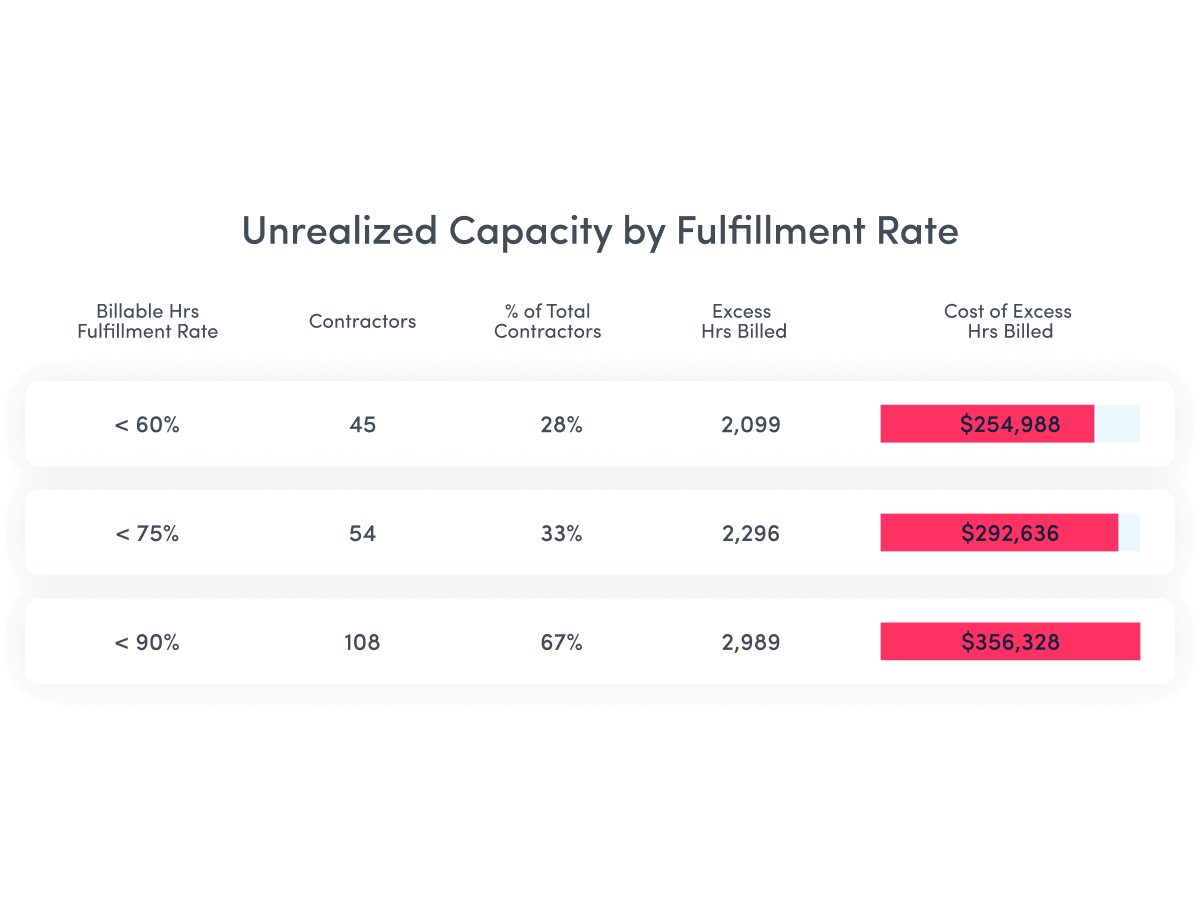

Utilization Optimization

Optimize contractor allocation and spending

- View unrealized capacity by fulfillment rate bands to optimize contractor value

- Compare productive hours to billed hours across contractors, teams and vendors

- Make data-driven decisions about contractor renewals and resource planning

Automated Compliance

Replace manual audits with systematic monitoring

- Ensure contract terms are met with automated reconciliation instead of manual validation

- Maintain billing oversight without requiring contractors to adopt new time tracking systems

- Turn contractor billing from a trust-based system into a data-verified process

Explore ActivTrak’s key features

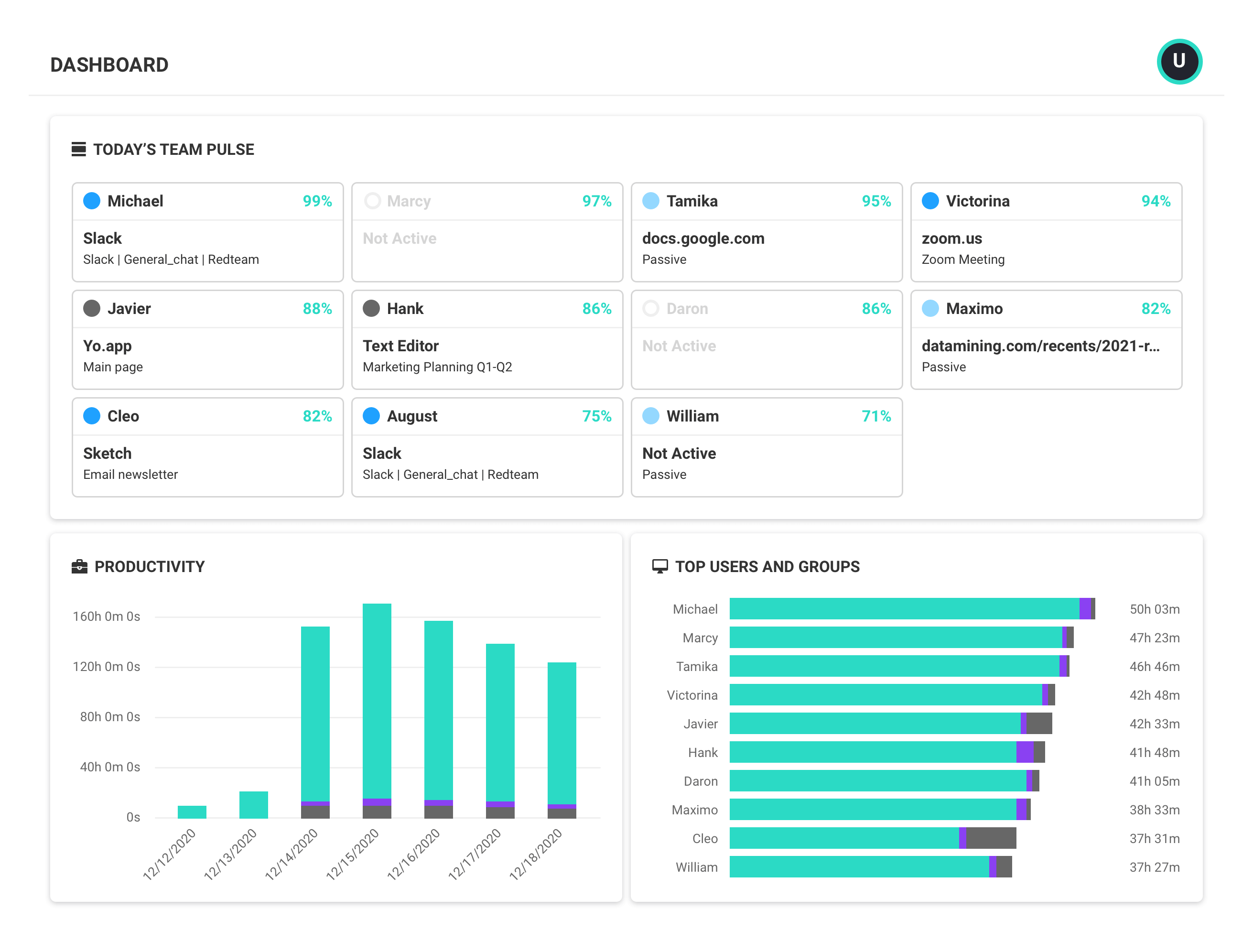

Dashboards

View a summary of workforce productivity metrics to keep a pulse on issues that impact burnout, engagement and efficiency.

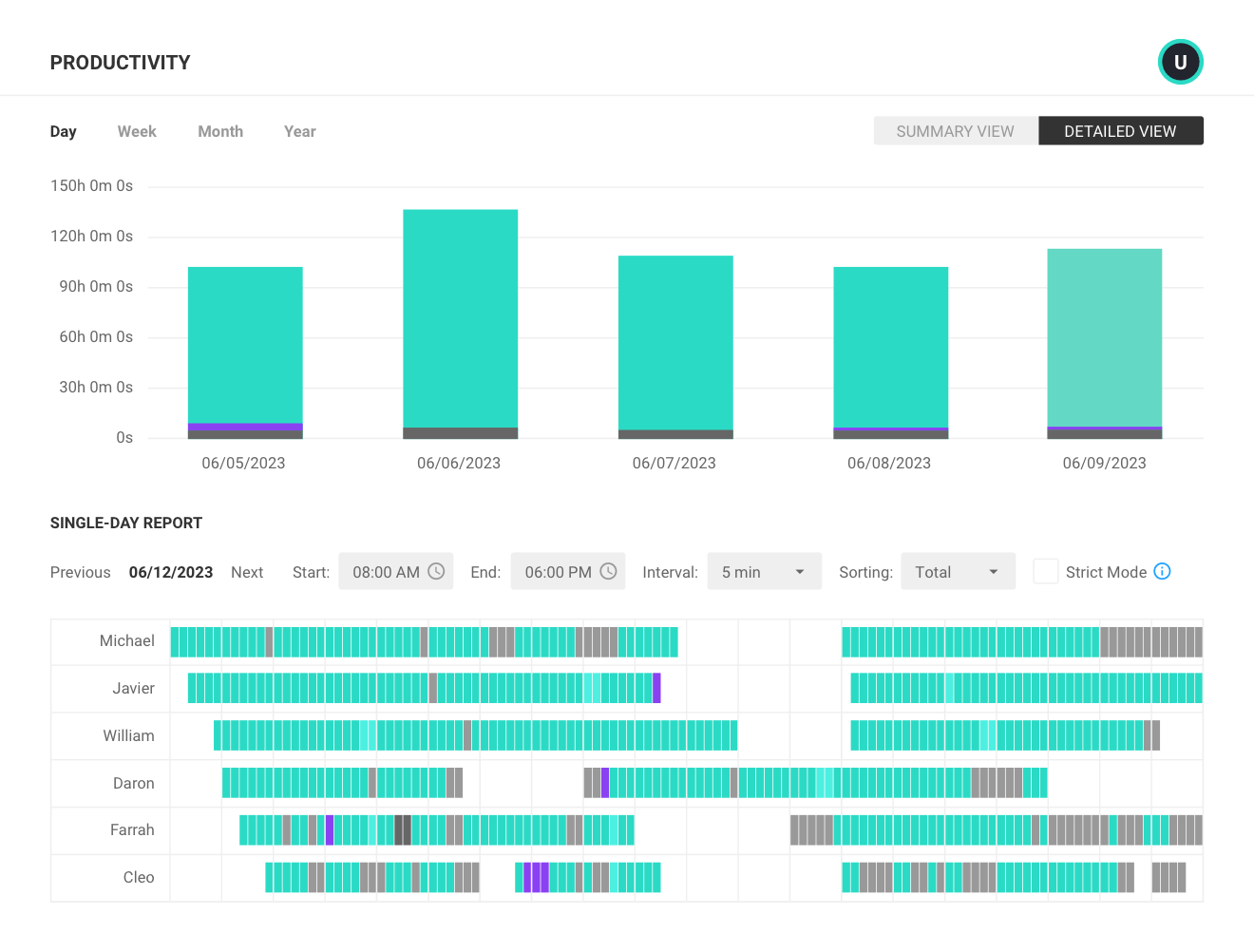

Productivity Reports

Gain valuable insights into factors affecting employee productivity with reports that drill down by date range, users, computers and other criteria.

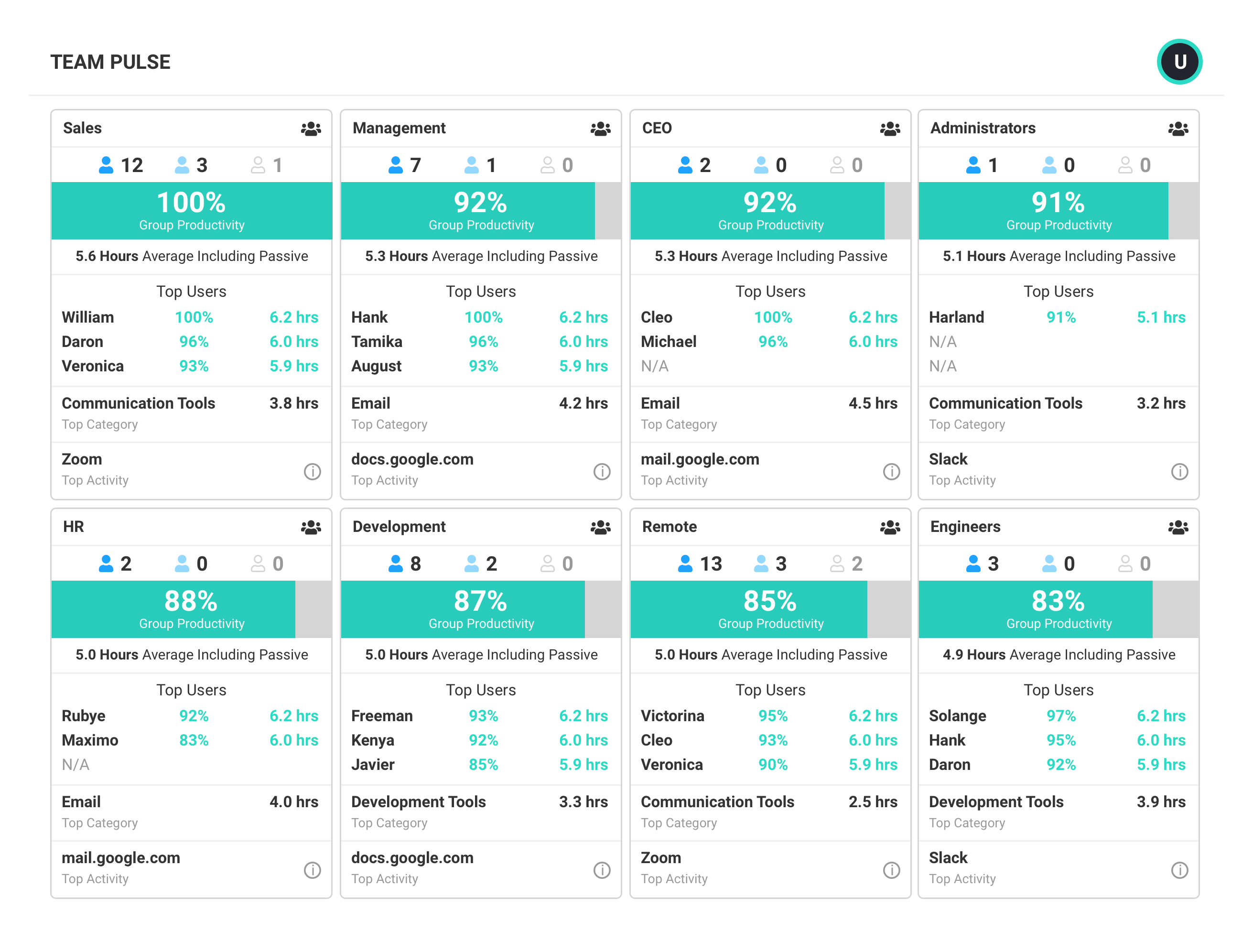

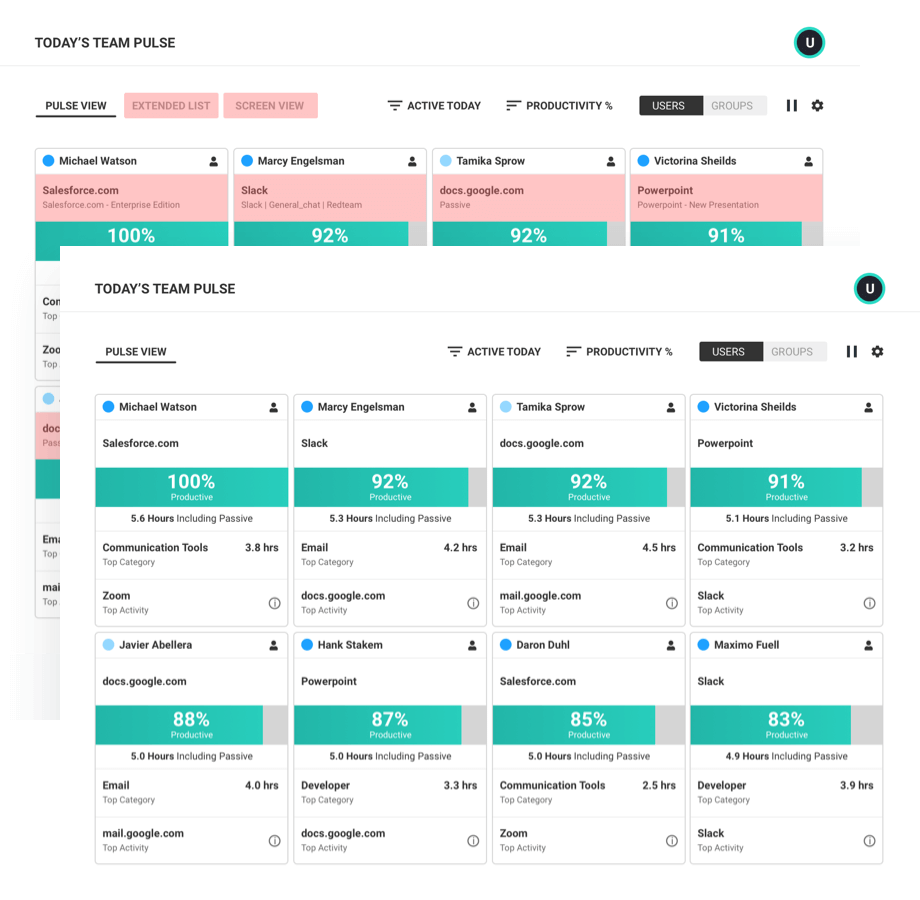

Team Productivity

See team productivity and availability status to assess workload balance and identify best practices of top performers.

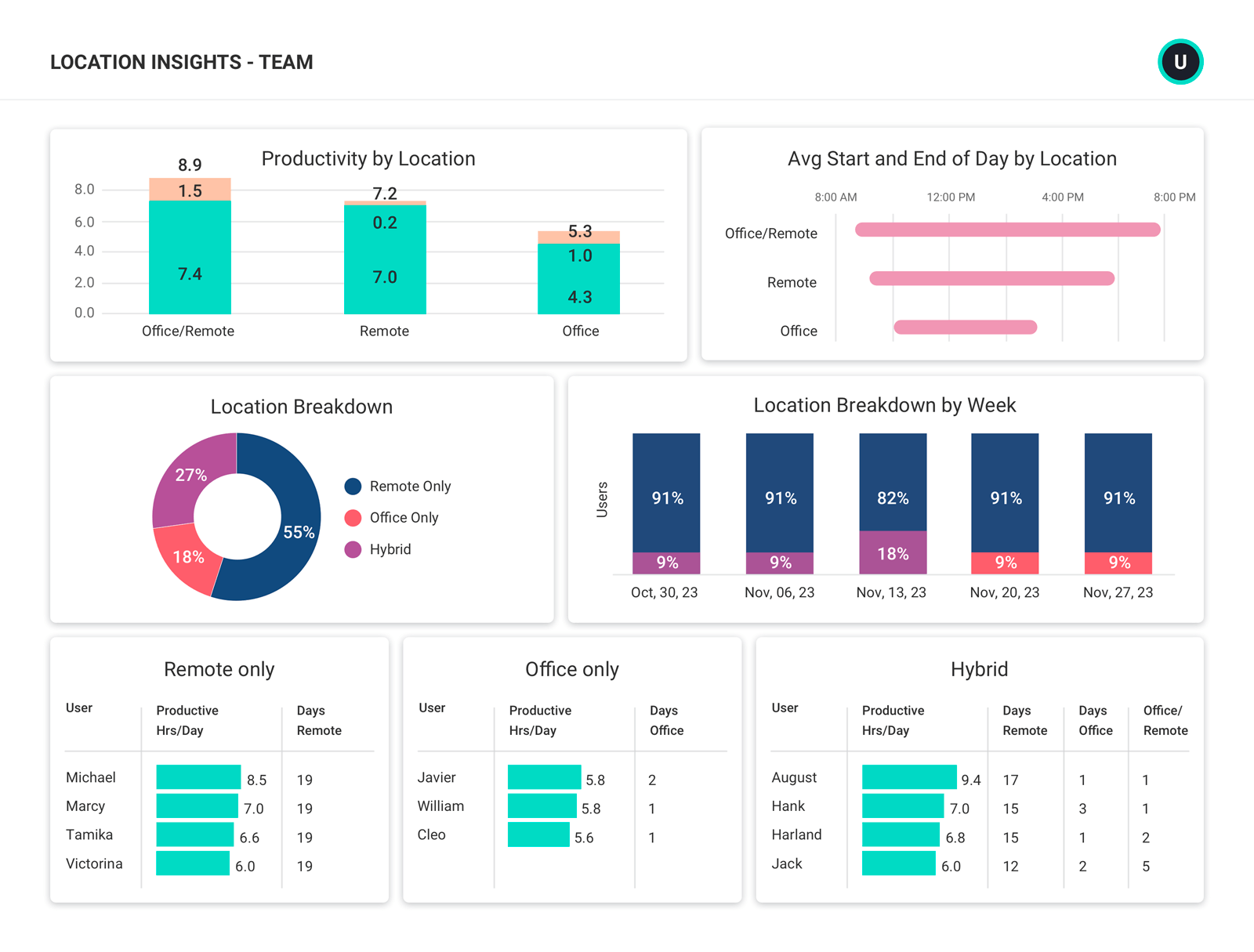

Location Insights

Make data-driven decisions about hybrid work with insight into where employees work — and where they work best.

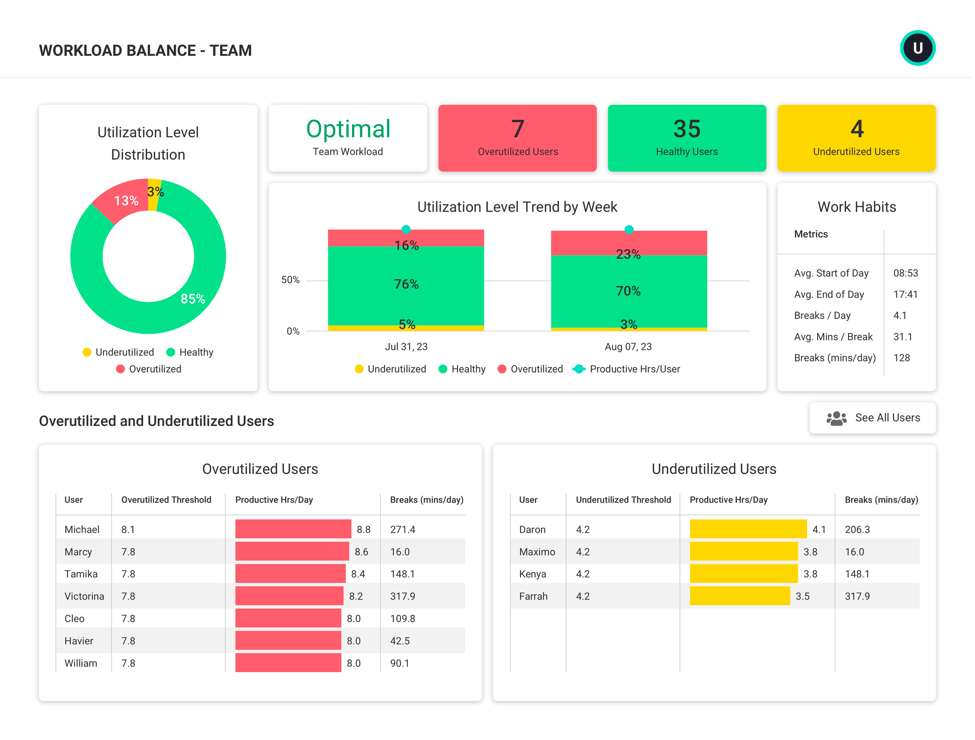

Workload Management

Uncover opportunities across individuals and teams to balance workloads, increase efficiency and support healthy work habits.

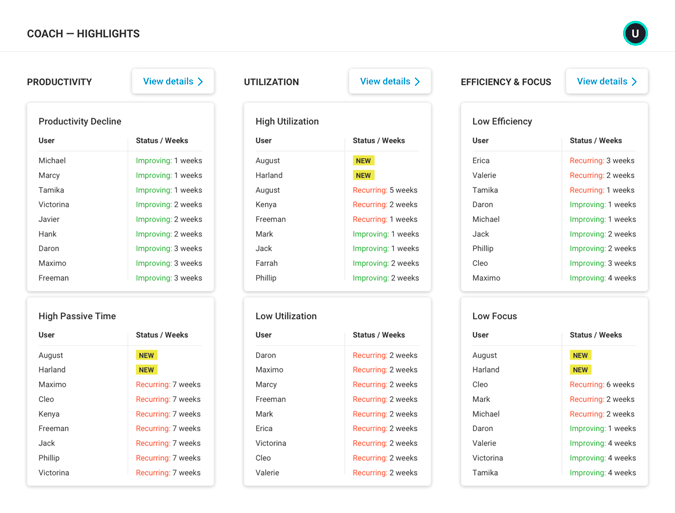

Productivity Coaching

Leverage expert guidance to drive collaborative discussions and empower employees to take charge of their professional development.

Integrations

Combine workforce activity data with key applications and data sources to understand broader business context.

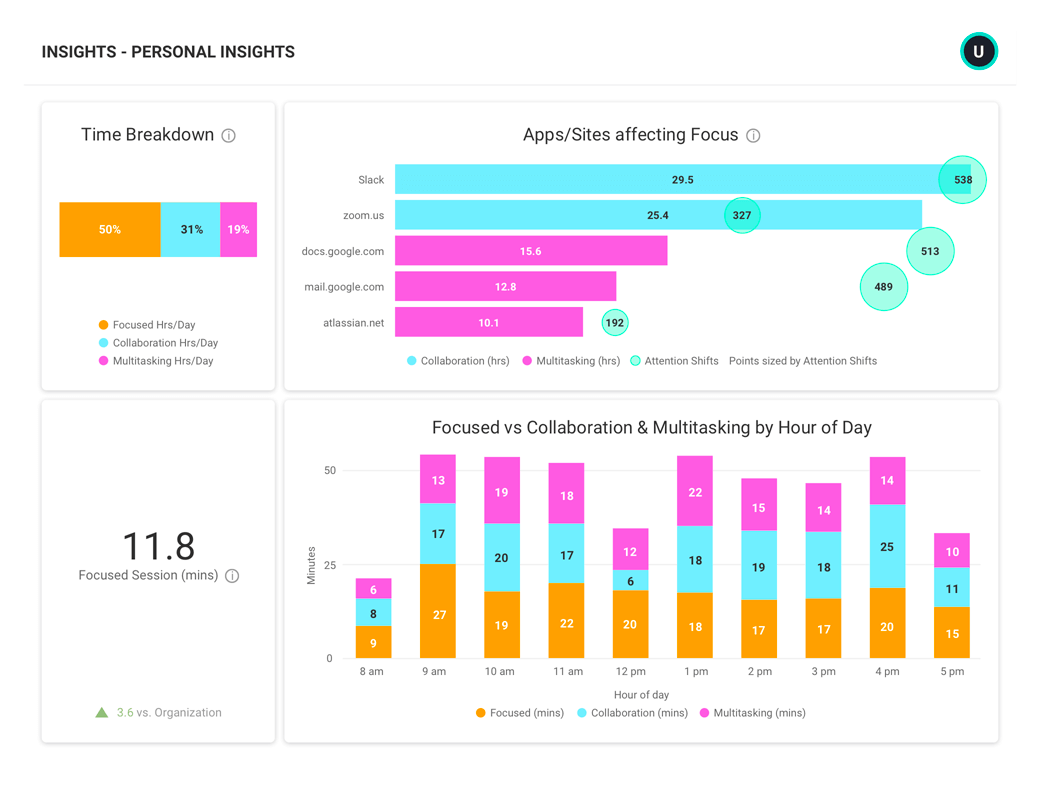

Personal Insights

Empower employees to improve productivity, focus and work-life balance by providing deep insights into individual work habits.

Privacy-first Analytics

Safeguard privacy and confidentiality without loss of any productivity insights, and forge higher levels of trust with employees.

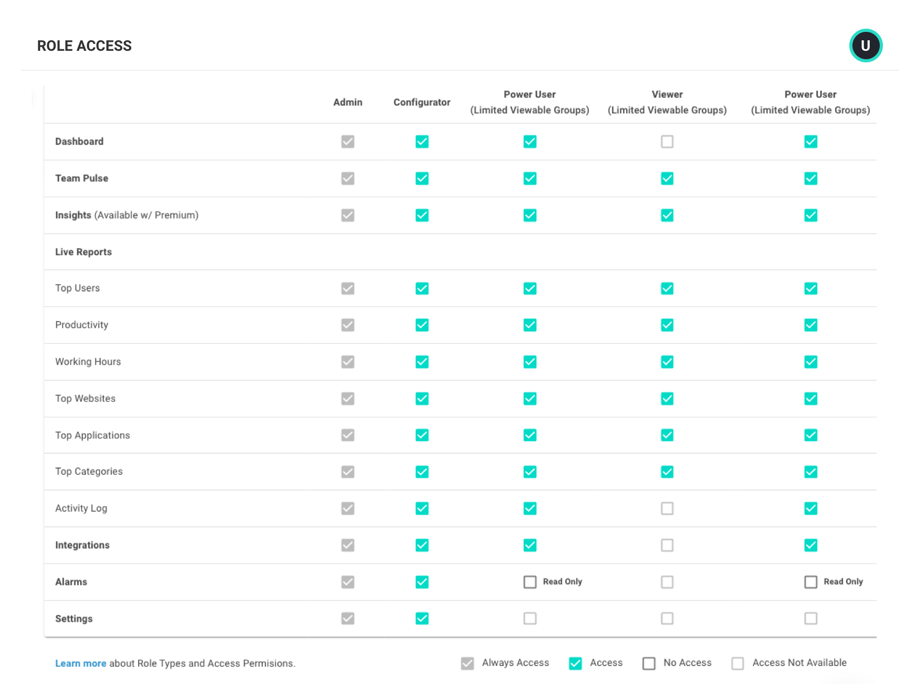

User Management

ActivTrak makes it easy to invite and manage users within your ActivTrak account.

ActivTrak fits your stack

Get deeper insights, integrate with any app.

Saleforce

Microsoft Teams

Slack

ServiceNow

Zendesk

Zoom

Microsoft Viva

Lattice

Qualtrics XM

Jira Software

Workday

ADP

Culture Amp

Asana

How it works

Collect

Use the ActivTrak Agent to gather digital activity data about how employees work while safeguarding employee privacy.

Analyze

Assess productivity drivers, engagement levels and work habits through intuitive dashboards and AI-powered reports.

Optimize

Use ActivTrak Coach to improve productivity, performance and resource utilization for organizational health and well-being.

FAQs about contractor billing reconciliation

What is contractor and vendor statement reconciliation?

Contractor billing reconciliation is the vendor reconciliation process of validating contractor invoices against actual work performed. This includes comparing billed hours to productive hours worked, identifying discrepancies and ensuring contract terms are met. Organizations with significant contractor spend often face challenges validating billing accuracy as manual processes are time-consuming and prone to data entry errors. Traditional approaches also lack the ability to detect duplicate payments or maintain accurate financial records across multiple vendors. An analytics-based approach provides automated reconciliation, reducing human error while ensuring accurate and up-to-date records.

Why is contractor and vendor statement reconciliation important?

Organizations lose up to 30% in contractor spend due to overbilling, billing errors and duplicate payments. Without an efficient validation method, companies lack visibility into billing accuracy and have no data to dispute overcharges or maintain accurate financial records. Manual processes are time-consuming and prone to data entry errors that can impact cash flows. Contractor billing reconciliation transforms billing from a trust-based system into a data-verified process, enabling finance and operations leaders to identify problems, recover costs and ensure timely, accurate payments. This results in significant cost savings and improved vendor accountability.

What are the benefits of contractor and vendor statement reconciliation software?

Using an automated workforce analytics tool to reconcile contractor billing provides visibility that manual processes cannot match. Benefits include identifying and recovering overbilled amounts with concrete data evidence, automating validation processes that are time-consuming and prone to data entry errors, seeing patterns and trends across teams and vendors, ensuring contract compliance through systematic monitoring, reducing human error in validation and maintaining accurate financial records. This automation eliminates manual processes that typically take days while ensuring accurate payment and helping organizations better manage outstanding invoices and balance tracking. Organizations with 100+ contractors and $5M+ annual contractor spend can identify and recover substantial excess costs while improving cash flows.

What are the challenges of contractor and vendor statement validation?

Common challenges include no visibility into billing accuracy, time-consuming manual validation , data entry errors leading to duplicate payments or processing errors, lack of data to dispute overcharges, no systematic compliance checking and difficulty maintaining accurate financial records across multiple vendors. Traditional approaches require reconciling vendor invoices against internal records manually, which creates bottlenecks and increases the risk of errors. Many organizations struggle to track outstanding invoices and balances across their accounts payable ledger efficiently. Without an automated workforce analytics tool, finance teams spend significant time on manual processes that could be streamlined, ultimately accepting billing errors and potential issues as the cost of doing business.

What is ActivTrak’s approach to contractor and vendor billing reconciliation?

ActivTrak provides analytics-based reconciliation that compares billed hours to productive hours worked without requiring contractors to change their billing workflows. Our solution uses passive monitoring through the ActivTrak Agent to capture productive work, which is then compared against billing data imported via Google Sheets. Pre-built BI templates for PowerBI, Tableau and Looker provide instant visibility into excess billing, utilization patterns and financial impact. This automation validates billing accuracy while respecting contractor autonomy and maintaining productivity, replacing time-consuming manual processes with a streamlined vendor reconciliation process that ensures accurate and up-to-date financial records.